Better Alternatives to Save Up for Yourself and Your Family

Saving money is no longer just about setting aside spare cash—it is about protecting your future, creating opportunities, and ensuring security for the people you love. In today’s uncertain world, relying on a single savings method is risky. Inflation, emergencies, health concerns, and unexpected life changes can quickly erode unplanned finances.

To truly save for yourself and your family, you need smart, flexible, and purpose-driven alternatives that balance safety, growth, and accessibility. This blog explores practical and effective saving options that go beyond the traditional piggy bank mindset and help you build long-term stability.

Why Traditional Saving Alone Is Not Enough

A basic savings account is important, but on its own, it often falls short. Interest rates are usually low, while the cost of living continues to rise. This means your money may lose value over time if it simply sits idle.

Better saving strategies focus on:

Protection (for emergencies and health)

Growth (to keep up with inflation)

Accessibility (when your family needs funds quickly)

Purpose (education, home, retirement, legacy)

Smart saving is about placing your money where it works for you.

Build a Strong Emergency Fund First

Before exploring advanced options, establish a solid emergency fund. This is non-negotiable.

Why it matters

An emergency fund protects your family from sudden crises such as medical bills, job loss, or urgent repairs. Without it, people often resort to loans or debt.

How to do it

Save at least 3–6 months of essential expenses

Keep it liquid and easily accessible

Separate it from daily spending money

This fund is not for wants—it is for peace of mind.

Smarter Alternatives for Saving and Growth

1. Goal-Based Savings Buckets

Instead of one general savings account, divide your savings into clear categories:

Education fund

Health fund

Housing or renovation fund

Travel or family milestones

This method keeps you disciplined and motivated. Each peso saved has a purpose, reducing the temptation to spend it impulsively.

2. High-Yield or Digital Savings Options

Modern savings platforms often offer higher interest rates than traditional accounts. While still relatively safe, they allow your money to grow faster without sacrificing accessibility.

Best for:

Short- to medium-term goals

Emergency fund storage

Parents who want flexibility

Always ensure these platforms are reputable and regulated.

3. Insurance with Savings or Investment Components

Life and health insurance are not expenses—they are financial shields for your family.

Some policies allow you to:

Build cash value over time

Protect dependents financially

Prepare for long-term needs

This is especially important for breadwinners. Saving while protecting your family is a powerful combination.

4. Education-Focused Saving Plans

If you have children, education planning should start early. Small, consistent contributions can grow significantly over time.

Benefits:

Reduces future financial pressure

Prevents debt for education

Gives children more choices later in life

Education savings are investments in opportunity, not just money.

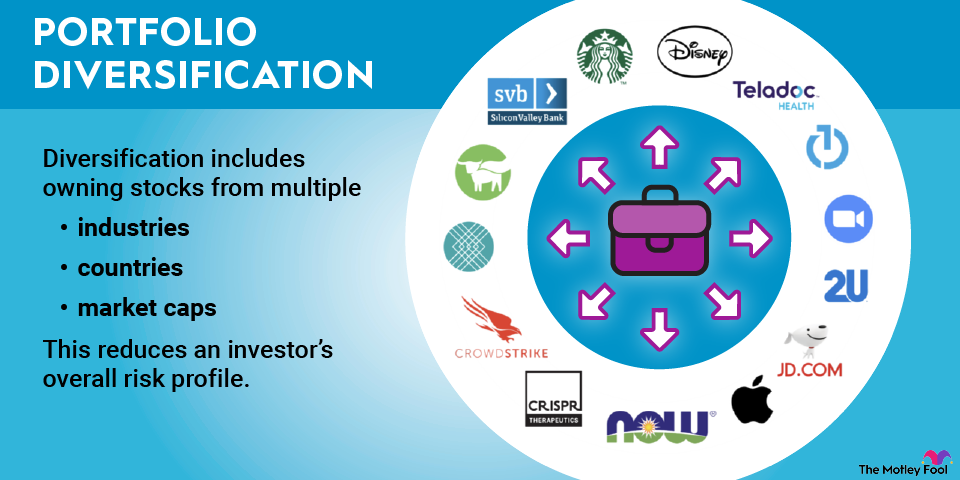

5. Long-Term Investment-Based Savings

For long-term goals like retirement or wealth-building, savings that grow through investments offer better potential returns.

These may involve:

Diversified funds

Retirement-focused plans

Long-term disciplined contributions

While these come with some risk, time and consistency help manage volatility. The key is starting early and staying patient.

Family-Oriented Saving Habits That Matter

Save as a Team

Teach children and family members the value of saving. Even small habits—like setting aside allowances or budgeting together—build a culture of responsibility and foresight.

Automate Whenever Possible

Automatic transfers to savings reduce the temptation to skip contributions. Treat savings like a fixed bill you pay yourself first.

Review and Adjust Regularly

Life changes—so should your saving strategy. Review your goals annually or when major events happen (marriage, birth of a child, career changes).

Avoid Common Saving Mistakes

Saving without a clear goal

Ignoring inflation

Relying solely on one savings method

Delaying saving “until income increases”

The best time to save is always now, even if the amount feels small.

Saving Is an Act of Love and Responsibility

Saving for yourself and your family is not about fear—it is about care. It is about choosing stability over stress, preparation over panic, and intention over chance.

Better saving alternatives allow your money to grow, protect your loved ones, and support your dreams. With the right mix of discipline, planning, and smart choices, you create a future where your family is not just surviving—but secure, confident, and free to focus on what truly matters.

Your savings today are your family’s safety tomorrow.

No comments:

Post a Comment